“I am 33, I’m making good money, but how the heck do I know if I’m saving enough? Where should I be by now for retirement?”

First and foremost – your thirties are the PERFECT time to be thinking about your retirement because you can actually have a BIG impact on your savings. You can get scholarships to pay for your kid’s college, but there’s no financial aid for retirement. Despite this, Americans have a $3 TRILLION dollar retirement savings gap. So how do you know if you’re on track??

Trigger warning: there are some big numbers in the below for how much you need to save. Don’t panic when you read them. Use the information to motivate you to make a plan. Because I know thinking about retirement after a 12-hour day sounds terrible, I am a big advocate of taking a personal finance day at least once per year when you dig in on how much you have saved, what percentage of your paycheck you’re currently saving (just as important as $s), etc. Email me for more information.

If you have 5 minutes…Fidelity says you should have your total salary saved by the time you’re 30. So if you make $150K, you should have $150K saved. But big caveat, this estimate isn’t personalized, doesn’t take into account your life expectancy (women live longer than men!), your investing strategy, etc.

Another benchmark for where to start is from Alexa Van Tobel’s book Financially Fearless (which I highly recommend). She is an HBS dropout who started and sold the financial planning company LearnVest.

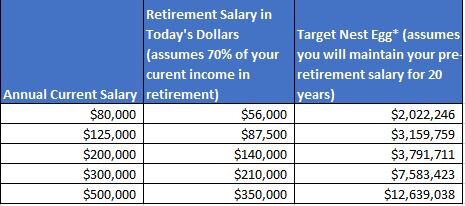

Back in 2012, she estimated the below retirement goals based on a few salaries:

Source: Alexa Van Tobel, “Financially Fearless: The LearnVest Program for Taking Control of Your Money,” p. 105. Please note that they did not share the rate of return assumed but I assume they used a conservative 6% nominal rate of return net 3% for inflation.

Totally freaked out looking at that $2-$12M numbers? Yup, they’re scary AF, but I want to put those numbers in front of you in part TO scare you. Most financial planners say you can put off most of your other goals like saving for a house but with retirement savings, due to the magic that is compound interest, the earlier you start saving the less you will have to save!!! If you’re in your 30s or younger reading this and you’re not happy with your current number,, you still have LOTS of time to make changes.

I have seen seniors who forgo taking medications because it’s not in their budget, and I decided a long time ago, I never wanted that to be me. You might not have my level of terror at being old and broke, but I do want to encourage you all to know your numbers and have a plan because not having a plan is just a really bad plan.

Above are two quick gut checks to tell if you’re on track. If you have more time, here is a more detailed option.

if you have an hour…check out an online retirement calculator which can give you a personalized idea of where you stand. Plug in your age, income, current savings, and how much you save each month, then voila, it will tell you how you’re doing. If you haven’t noticed, I’m a fan of Nerdwallet and I like their tool. They make some pretty conservative assumptions about your rate of return (5% return minus 3% inflation so only 2%!) and 2% salary increases each year (praying for better than that), but it’s a good starting place.

if you have more time and want to dive in more, what’s next?

-

Figure out how much you have saved for retirement: Spend 5 minutes checking the balance of your current 401K and any non-work IRAs. Write down any other retirement assets you might have (still got an old 401K lingering??). How much have you saved to-date? Have you meet the high-level goal of having savings equivalent to your income?

-

What are you saving each month as a percentage of your salary? Some financial planners, use the 50 / 20 / 30 rule. 50% of your income goes to essentials (rent, transportation to work, etc.), 20% for your future self, and 30% for your lifestyle (read your splurges – which for me is travel!). Are you meeting that 20% threshold? How much are you saving for retirement each month? What other goals do you have (e.g., paying of credit card debt, saving for a house) and how do they stack up for you against retirement savings?

-

Use one of the above methods to figure out how you’re doing: Where do you stand? Are you on track or do you want to up your retirement savings? Are you maxing out your 401K at work ($19K / year)? Are you fully funding your IRA? What would have to change in your life for you to save more?

-

What’s your actual YTD return been on your retirement accounts? I have been keeping almost 25% of my money in cash because I’m afraid there’s going to be a recession. As a result, my returns have been significantly lower than the S&P 5.3% YTD return this year. That means I’ve missed out on a lot of income growth – which I really can’t afford. How are you doing?