Source: Forbes, 2019

Forbes recently featured Serena Williams on the cover for being a self-made millionaire. In addition to being one of the greatest to ever play, she also launched a clothing line and built a $225M fortune. While I’m not certainly not chasing money or advocating success means being on the Forbes list (believe me, I wouldn’t work in healthy school lunch if that was my goal), Serena wanted to come back from maternity leave and prove she could win more Grand Slams. She came crushingly close this US Open but still set a record for being the oldest woman to play in a final. How did she get there? By setting a big, hairy audacious goal!!!

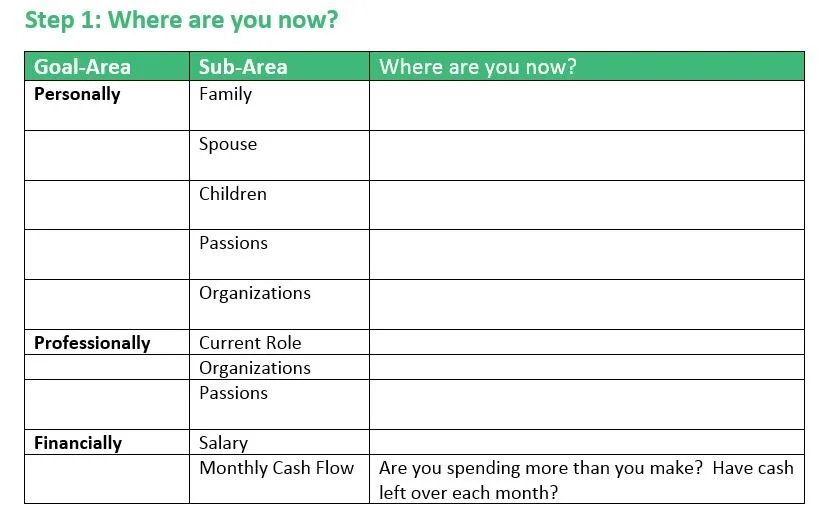

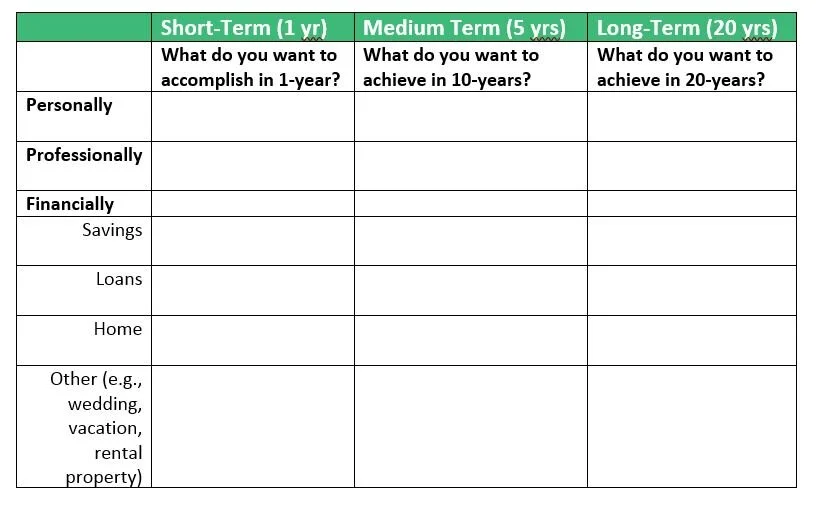

The point of this post is to help you figure out your dreams (financial and otherwise) so you can make a plan to get there. It can mean switching careers if your dream job is running a Solar energy startup and you currently work in health care. It could also mean dramatically reevaluating your spending if you want to retire by 40 to travel the world, but currently have $10,000 in your retirement accounts. Whatever your dream, you’re going to need money to achieve it (living in a yurt still costs money). So, today, I want you to write down your vision for the future, break it into digestible, achievable parts, and then figure out what you’re going to do today, next year, and in five years to help you achieve it.

For me, in the next five years, I want to have my own business supporting women in achieving financial freedom. This will enable me to do good and eventually be my own boss so I can be more involved in politics (either as a donor or a candidate, agh!) and balance being a mom (also something I hope to achieve in the next five years) with having a meaningful career. To help me achieve these goals, I started a process where I write down one thing I am going to do each week related to these goal areas. Right now, I’m toning down the politics to focus on building a business, but that’s ok since the first part of the plan is to get to financial independence. Sometimes I deviate from the plan or go a week without achieving what I intended to, but at least I know I’m spending my energy each week trying to get where I want to go.

So, here are three exercises to help you figure out where you are today and what you can do to help you achieve your money goals!

It’s well documented that sharing your goals with others is a good way to hold yourself accountable to achieving them so please send me your goals if you want a buddy to keep you on track! What’s your vision for the future and how will you get there?