Hi, I'm Eryn

Do you want to be the first to know about new blog posts and free financial education webinars?

Are you ready to take charge of your financial future?

“Can't recommend the 10-week money boot camp enough! Eryn does a wonderful job of breaking down complex financial concepts, making them easy to understand and fun to learn. With the knowledge I've gained, I found savings in my budget and put more money towards my retirement-- more than covering the cost of the course!”

"I increased my 401k contribution (of course!) I also switched from a traditional to a Roth. In the past I didn't know the difference but assumed a Roth was a fancy type of 401k for people who made way more money than me. Turns out, it's probably a better choice for my future financial needs now that I actually understand what it is!"

“I’m feeling really good about my financial plan (created during your class of course)! I created a budget and I’m sticking to it which is really satisfying, with automatic transfers to an emergency savings account, maxing out my 401K and most importantly - HAVE A PLAN FOR MY CREDIT CARD DEBT :)”

With the On-Demand Money Bootcamp, you receive:

Financial literacy in your pajamas

Eryn Schultz, MBA

As an MBA who struggled with student loans, spending and retirement, my goal is to help other high-earning women take charge of their finances and feel confident in their decisions.

Founder of Her Personal Finance

The program is facilitated by Eryn Schultz, a 2015 Harvard MBA. Eryn launched her business because she realized her MBA prepared her to manage a corporate balance sheet, but not her own finances. After years of self education*, helping hundreds of women answer questions on finances, and personally paying off $184K of student loans, Eryn launched her course to help other high-earning feel more comfortable taking action and avoid common mistakes.

She's spoken at business schools like Harvard, Kellogg, and Ross and been featured on NPR, CNBC, and many other national news publications.

*Eryn is sitting for the Certified Financial Planner exam in March 2022

75% of surveyed women who complete one of our boot camps take SOME action through class. While what you will achieve will vary based on your personal finance, most women trim some spending (e.g., an unused subscription), increase their 401K savings, transfer cash from their bank accounts to an investing account so it can start growing, and make a plan to pay off debt (student loan, credit card or mortgage) faster. Even a small change in behavior (saving 4% more of a typical post-MBA salary), can lead to large savings later in life. For example, investing ~$6K / year more in an IRA or 401K over the next 30 years could translate to $566.8K more in retirement. When you compare that to the course fee, class more than pays for itself.

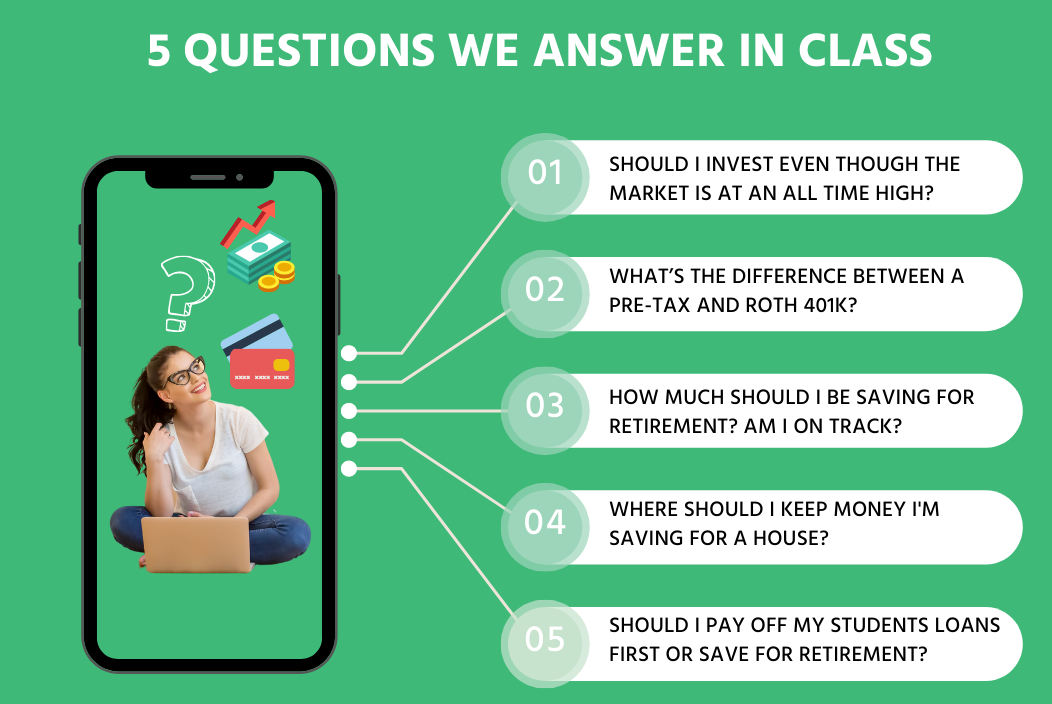

The "on-demand" version of the class includes 6-hours of recordings which can be taken at your own pace. There is also an Excel workbook that includes exercises that accompany each class. These exercises range from helping you calculate your net worth to modeling your future retirement and the tax-implications of a Roth versus a traditional accounts.

Class includes PowerPoint slides and a single Excel workbook with exercises to complete after every class. Most of the Excel assignments require you to really dig into your own numbers to figure out where your 401K is invested or how much you're spending each month. The first lesson is thought exercise to think about your goals and past money behaviors. While this is less quantitative than the main class materials, it's an important first step. You can take a look at the first class assignment that helps lay the foundation of your financial journey here.